Can You Sell a House in Foreclosure in Kentucky? (2026 Guide)

Yes, you can sell a house in foreclosure in Kentucky. You have the legal right to sell your property at any point before the foreclosure sale is confirmed by the court. Kentucky’s judicial foreclosure process typically takes 5-12 months, giving you time to explore your options. Many ask us “can you sell a house in foreclosure in Kentucky?“, and that answer is yes.

Key Points:

- You can sell at any stage before the court confirms the sale

- Kentucky requires all foreclosures to go through the court system (judicial foreclosure)

- The typical timeline runs 5-12 months from your first missed payment to auction

- Your options include traditional sale, short sale, or cash sale to an investor

- Acting early preserves more options and better protects your credit score

The rest of this guide explains exactly how the Kentucky foreclosure process works, what options you have at each stage, and how to take action to protect yourself and your family.

Understanding Your Situation

Why Foreclosure Happens

Foreclosure can happen to anyone. Job loss, unexpected medical expenses, divorce, or broader economic shifts can quickly turn a manageable mortgage into an overwhelming burden. If you’re facing foreclosure, you’re not alone, and this situation doesn’t define you as a person or a homeowner.

What matters now is understanding your options and taking action while you still have choices.

The Real Stakes

Let’s be direct about what’s at risk:

Credit Impact: A completed foreclosure typically drops your credit score by 100 points or more. This negative mark stays on your credit report for seven years, making it harder to rent an apartment, get approved for car loans, or qualify for another mortgage.

Deficiency Judgment: Kentucky law allows lenders to pursue a deficiency judgment against you. This means if your home sells at auction for less than what you owe, you could still be on the hook for the difference.

Emotional Toll: The uncertainty and stress of foreclosure affects your entire household. The constant worry about losing your home takes a real toll.

But here’s what’s important: Taking action now changes your outcome. The earlier you act, the more options you have. Even if you’re deep into the process, you likely still have choices. This guide will help you understand exactly what those choices are.

The Kentucky Foreclosure Process Explained

Understanding how foreclosure works in Kentucky gives you power. When you know what’s coming and when, you can make informed decisions about how to respond.

Kentucky is a judicial foreclosure state, which means every foreclosure must go through the court system. A judge must approve the foreclosure before your home can be sold. The foreclosure process in Kentucky typically takes 5-12 months, depending on the court’s docket in your county and whether the foreclosure is contested. Jefferson County (Louisville) may have different timelines than smaller rural counties due to varying caseloads.

How Kentucky Compares to Other States

| Factor | Kentucky | Non-Judicial States (e.g., Texas, Georgia) | Other Judicial States (e.g., Ohio, Illinois) |

|---|---|---|---|

| Foreclosure Type | Judicial (court required) | Non-judicial (no court needed) | Judicial (court required) |

| Typical Timeline | 5-12 months | 2-4 months | 6-15 months |

| Court Oversight | Yes, judge must approve | No | Yes |

| Right to Respond | 20 days to answer lawsuit | Limited notice period | Varies (20-30 days typical) |

| Redemption Period | 6 months (if sold under 2/3 value) | Often none | Varies by state |

| Deficiency Judgments | Allowed | Varies by state | Usually allowed |

Kentucky’s judicial process provides more time and legal protections compared to non-judicial states, but you must use that time wisely. The longer timeline is an opportunity, not a reason to delay action.

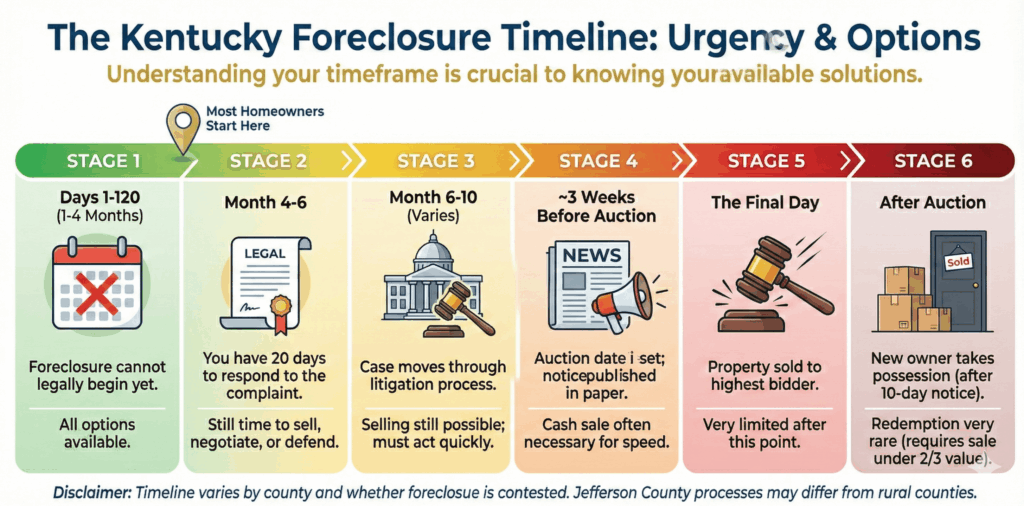

The Kentucky Foreclosure Timeline

Stage 1: Missed Payments (Days 1-120)

The foreclosure process begins when you fall behind on your mortgage payments. However, your lender cannot legally start formal foreclosure proceedings right away.

What happens during this stage:

Most mortgage contracts include a grace period of 10-15 days after your payment due date before late fees kick in. Check your mortgage statement or promissory note to confirm your specific grace period.

Federal law requires your loan servicer to attempt to contact you by phone within 36 days of a missed payment to discuss options. They must also send you written information about loss mitigation options (ways to avoid foreclosure) within 45 days of your first missed payment.

The 120-day rule: Under federal law (12 C.F.R. § 1024.41), your servicer generally cannot begin the formal foreclosure process until you are more than 120 days past due on payments. Exceptions exist, such as when foreclosure is based on a due-on-sale clause violation or when the servicer is joining an existing foreclosure by another lienholder. However, for most homeowners facing standard payment default, this four-month window exists specifically to give you time to explore alternatives.

selling your house through any method you choose. If you’re going to act, now is the time.

Stage 2: Lawsuit Filed (Pre-Foreclosure)

Once you pass the 120-day mark, your lender can initiate foreclosure by filing a lawsuit against you in circuit court.

What happens during this stage:

Your lender files a complaint in the circuit court in the county where your property is located. They also file a lis pendens (notice of pending action), which becomes part of the public record and notifies anyone searching the title that foreclosure proceedings have begun.

You will be served with a summons and complaint, either by a sheriff’s deputy or a warning order attorney. This officially notifies you that the lawsuit has begun.

Critical deadline: Once you receive the summons and complaint, you have 20 days to file a response with the court (Ky. R. Civ. P. 4.02). This deadline matters. If you don’t respond, the lender can request a default judgment, which speeds up the process significantly.

The court typically sends the case to a master commissioner (a court-appointed official) who reviews the case and makes recommendations to the judge.

You can still sell your house, negotiate with your lender, or defend against the foreclosure in court. However, your timeline is now more compressed. If you’re considering selling, you need to move quickly.

Stage 3: Court Proceedings

What happens next depends on whether you responded to the lawsuit.

If you didn’t respond: The lender will request a default judgment. If the master commissioner recommends it and the judge agrees, the court will enter judgment allowing the foreclosure sale to proceed. This can happen relatively quickly.

If you did respond: The case proceeds through the litigation process. Your lender may file a motion for summary judgment, arguing that there’s no real dispute about the facts and they should win as a matter of law. If the court denies summary judgment, the case may go to trial.

This stage can take anywhere from 2-6 months or longer, depending on whether the foreclosure is contested and how busy the court’s docket is.

Your options at this stage: Selling remains possible, but you’re working against the clock. This is when working with a cash buyer who can close quickly becomes more attractive, as traditional sales may not close fast enough.

Stage 4: Notice of Sale

Once the court enters judgment in favor of the lender, the master commissioner prepares for the foreclosure sale.

What happens during this stage:

The master commissioner prepares a notice of sale that includes the date, time, location, and terms of the auction. This notice must be posted at or near your property and published in a local newspaper for three consecutive weeks before the sale date.

Kentucky law requires two appraisers to conduct a drive-by inspection of your property to establish its value (KRS § 426.560). This appraisal matters because it affects your redemption rights after the sale.

Your options at this stage: Your window is narrowing, but you can still sell before the auction date. If you have a signed contract with a buyer and can close before the scheduled sale, you can stop the foreclosure. Cash buyers who can close in 10-14 days become particularly valuable at this stage.

Stage 5: Foreclosure Auction

The auction is conducted by the master commissioner’s office, typically at the courthouse or another designated location.

What happens during this stage:

Your lender usually opens the bidding with a “credit bid,” meaning they bid the amount you owe (or some portion of it) without having to put up cash. If no one outbids the lender, they become the new owner. If a third party bids higher in cash, that person becomes the new owner and the proceeds go toward paying off your mortgage.

After the auction, the sale must be confirmed by the court before it becomes final.

Your options at this stage: Once the auction occurs, your options become very limited. However, until the court confirms the sale, there may still be narrow opportunities to intervene.

Stage 6: Post-Sale

After the sale is confirmed, the new owner is entitled to take possession of the property.

What happens during this stage:

The new owner must provide you with 10 days’ notice before taking possession (KRS § 426.260). If you don’t leave voluntarily, they can obtain a writ of possession from the court to have you removed.

Redemption rights: Kentucky law provides a redemption period, but only under certain circumstances. If your home sold at auction for less than two-thirds of its appraised value, you have six months from the date of the auction sale to redeem (buy back) the property by paying the sale price plus 10% interest and any reasonable costs incurred by the purchaser (KRS § 426.530). Note that while the clock starts at the auction date, this right isn’t practically actionable until the court confirms the sale.

Important: If the property sold for more than two-thirds of the appraised value, there is no redemption period. The sale is final.

Deficiency judgment: If the sale price didn’t cover what you owed, your lender can pursue a deficiency judgment against you for the difference (KRS § 426.005). This means foreclosure may not end your financial obligation.

Get An Answer Today

You deserve clarity about your options. At We Buy 502, we specialize in making foreclosure decisions simple and straightforward with no pressure—just honest assessments.

Our process is quick:

- Speak with a specialist at (502) 849-5950 or submit your property details below

- Get your personalized cash offer within 24 hours

- Explore your real options: sell, refinance, or take back control

Why choose We Buy 502? We evaluate every Kentucky property fairly and show you whether a cash sale works for your situation—or suggest what might work better.

Get Your Fair Cash Offer

Your Foreclosure Options in Kentucky

You have more choices than you might think. Here’s a detailed look at each option available to Kentucky homeowners facing foreclosure.

Option 1: Reinstatement (Catch Up on Payments)

Reinstatement means paying all your missed payments, plus late fees, penalties, and any legal costs the lender has incurred, to bring your loan current and stop the foreclosure.

Kentucky-specific consideration: Unlike some states, Kentucky does not give you an automatic legal right to reinstate your loan before the foreclosure sale, unless you have a high-cost home loan. However, many mortgage contracts do include reinstatement provisions. Check your loan documents or contact your lender to find out if reinstatement is an option for you.

This option works best if: You experienced a temporary hardship that’s now resolved, you have access to the funds needed to catch up, and you want to keep your home.

Option 2: Loan Modification

A loan modification permanently changes the terms of your mortgage to make payments more affordable. This might include reducing your interest rate, extending your loan term, or in some cases, reducing the principal balance.

Federal law requires your servicer to consider you for loss mitigation options, including modification. You’ll need to submit a complete application with documentation of your income, expenses, and hardship.

This option works best if: Your income has permanently decreased but you can still afford a reduced payment, you want to stay in your home long-term, and you can document your financial situation.

Option 3: Forbearance

Forbearance is a temporary pause or reduction in your mortgage payments. It doesn’t eliminate what you owe; the missed payments are typically added to the end of your loan or required to be paid back over time.

This option works best if: You’re experiencing a short-term hardship (like a temporary job loss, medical recovery, or family emergency) and expect your income to return to normal soon.

Option 4: Refinance

Refinancing means replacing your current mortgage with a new one, ideally with better terms. This can lower your monthly payment or give you access to equity.

The catch: Refinancing requires you to qualify for a new loan, which means you need adequate credit and equity. If you’re already behind on payments, your credit score may have dropped, making refinancing difficult or impossible.

This option works best if: You have equity in your home, your credit is still relatively intact, you can qualify for a new loan, and you act before the foreclosure significantly damages your credit.

Option 5: Traditional Sale (With a Real Estate Agent)

Selling your house through a traditional real estate listing allows you to potentially get full market value. You’d work with a real estate agent, list the property, show it to buyers, negotiate offers, and close the sale. The proceeds pay off your mortgage, and you keep any remaining equity.

Timeline consideration: Traditional sales typically take 30-90 days or longer, depending on your local market and the condition of your home. You need enough time before the auction to complete the sale.

This option works best if: You have equity in your home, you have adequate time before the auction (ideally 60+ days), your property is in good condition or you can make necessary repairs, and maximizing your sale price is a priority.

Option 6: Short Sale

A short sale occurs when you sell your home for less than what you owe on the mortgage, and your lender agrees to accept the reduced payoff. This requires your lender’s approval, which can take weeks or even months.

Credit impact: A short sale still negatively affects your credit, but typically less severely than a completed foreclosure. You may also face tax consequences, as forgiven debt can sometimes be treated as taxable income.

This option works best if: You owe more than your home is worth (you’re “underwater”), you want to avoid foreclosure on your credit report, your lender is willing to negotiate, and you can document financial hardship.

Option 7: Cash Sale to an Investor

Selling to a cash buyer (like We Buy 502) means you can sell your house directly to an investor who pays cash and can close quickly, often in as little as 10-14 days. Cash buyers will purchase properties “as-is,” meaning you don’t need to make repairs or clean up before selling.

The trade-off: Cash buyers typically pay below market value (often 70-85% of what you might get in a traditional sale). You’re trading maximum price for speed, certainty, and convenience.

This option works best when:

- Your auction date is approaching and you need to close fast

- Your property needs significant repairs you can’t afford

- A traditional sale isn’t feasible given your timeline

- You prioritize certainty and speed over maximizing price

- You want to avoid the hassle of showings, repairs, and negotiations

This option may NOT be your best choice when:

- You have significant equity and plenty of time

- Your property is in good condition and would show well

- A traditional sale could net you substantially more even after agent commissions

- You’re early in the foreclosure process with many options still available

Our honest perspective: At We Buy 502, we believe in giving you straight information. A cash sale isn’t right for everyone. If you have time and equity, exploring a traditional sale first might put more money in your pocket. We’re happy to give you a no-obligation cash offer so you can compare your options, and we’ll tell you honestly if we think another path might serve you better.

Option 8: Deed in Lieu of Foreclosure

With a deed in lieu of foreclosure, you voluntarily transfer ownership of your property to your lender in exchange for being released from your mortgage obligation. This avoids the formal foreclosure process.

Important considerations: Your lender must agree to this arrangement. The credit impact is similar to a foreclosure. You may still face a deficiency judgment if your lender doesn’t agree to waive it.

You have no equity in the house, you want to end the process quickly, your lender is willing to accept the deed, and you can negotiate a waiver of any deficiency.

Option 9: Bankruptcy

Filing for bankruptcy triggers an “automatic stay” that immediately stops foreclosure proceedings, at least temporarily.

Chapter 7 bankruptcy can delay foreclosure for several months and eliminates your personal liability for the mortgage debt (including any deficiency judgment). However, if you’re behind on payments, you’ll likely still lose the home.

Chapter 13 bankruptcy allows you to catch up on missed mortgage payments over a 3-5 year repayment plan while making your regular monthly payments going forward. This can be a way to save your house if you have steady income.

You have multiple debts beyond just your mortgage, you need immediate relief from the foreclosure process, you want to keep your house and can afford ongoing payments (Chapter 13), or you want to eliminate deficiency judgment liability (Chapter 7).

Bankruptcy is a significant decision with long-term consequences. Consult with a bankruptcy attorney to understand how it would affect your specific situation.

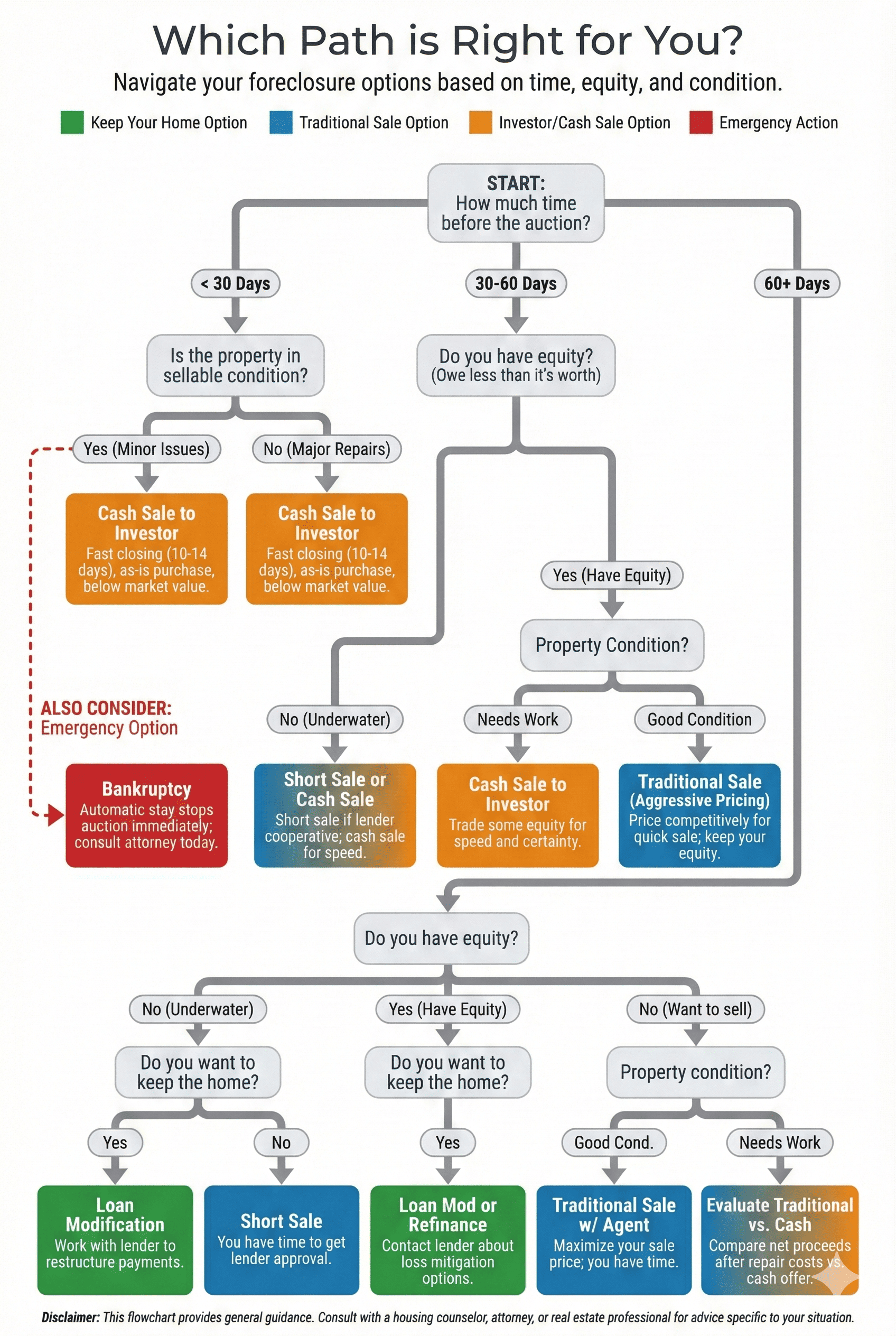

Decision Matrix: Which Option Fits Your Situation?

| Option | Time Needed | Equity Required | Credit Impact | Best For |

|---|---|---|---|---|

| Reinstatement | Immediate | No | None (if current after) | Temporary hardship resolved, have funds to catch up |

| Loan Modification | 30-90 days | No | Minimal | Reduced income, want to keep home long-term |

| Forbearance | 1-2 weeks | No | Minimal | Short-term hardship, expect recovery |

| Refinance | 30-45 days | Yes | Minimal | Good credit, equity available, early in process |

| Traditional Sale | 60-90+ days | Yes (ideally) | Missed payments show | Have time, property in good condition |

| Short Sale | 60-120+ days | No | Moderate | Underwater, lender willing to negotiate |

| Cash Sale | 10-14 days | No | Missed payments show | Time is short, need certainty, as-is condition |

| Deed in Lieu | 30-60 days | No | Significant | No equity, want quick resolution |

| Chapter 7 Bankruptcy | Immediate stay | No | Significant | Multiple debts, accept losing home |

| Chapter 13 Bankruptcy | Immediate stay | No | Significant | Want to keep home, can afford ongoing payments |

How to Sell Your House During Foreclosure

If you’ve decided that selling your house during foreclosure is your best option, here’s a step-by-step guide to making it happen.

Step 1: Assess Your Timeline

Start by understanding exactly where you are in the foreclosure process and how much time you have.

Questions to answer:

- Have you been served with foreclosure papers?

- Has a judgment been entered?

- Is an auction date scheduled? If so, when?

- How many days or weeks do you realistically have?

Your timeline determines which selling options are feasible. A traditional sale needs 60+ days. A short sale might need 30-90 days for lender approval plus closing time. A cash sale can close in as little as 10-14 days.

Step 2: Understand Your Equity Position

Your equity determines what happens after the sale.

Calculate your equity:

- Determine your home’s current market value (get a comparative market analysis from a real estate agent or request offers from cash buyers)

- Find out exactly what you owe (request a payoff statement from your lender that includes principal, interest, fees, and legal costs)

- Subtract what you owe from your home’s value

If you have positive equity: A sale can pay off your mortgage completely, and you walk away with cash.

If you have negative equity (you’re underwater): You’ll need to pursue a short sale (requires lender approval) or negotiate with your lender about the shortfall.

Step 3: Contact Your Lender

Inform your lender that you intend to sell the property. This is important for several reasons:

- They can provide an accurate payoff amount

- They can explain the short sale process if needed

- They may pause foreclosure proceedings while you pursue a sale

- It demonstrates good faith on your part

Request in writing:

- Current payoff amount

- Daily interest accrual (the amount your balance increases each day)

- Any fees that will be added before payoff

- Short sale application if you’re underwater

Tip: Lenders generally prefer to avoid foreclosure because it’s costly and time-consuming for them too. Being proactive about selling can work in your favor.

Step 4: Choose Your Sales Method

Based on your timeline and equity position, decide how you’ll sell:

Traditional sale with an agent: Best if you have 60+ days and positive equity. You’ll likely get the highest price but need time for listing, showings, negotiations, and closing.

Short sale: Necessary if you’re underwater. Factor in time for lender approval, which can take 30-90 days before you even get to closing.

Cash sale to investor: Best if time is short or your property needs work. Fastest path to closing, but you’ll accept a lower price.

You can also pursue multiple options simultaneously. For example, get a cash offer while also listing with an agent, and see which path produces a better outcome given your timeline.

Step 5: Price Strategically

Your asking price needs to accomplish specific goals:

At minimum, your sale price must cover:

- Your mortgage payoff (including all fees and accrued interest)

- Closing costs (typically 2-3% of sale price)

- Real estate agent commissions if using an agent (typically 5-6%)

- Any other liens on the property

If you’re pursuing a short sale: Your lender must approve the price, so work with an agent experienced in short sales who can help you navigate lender requirements.

If speed is critical: Pricing slightly below market value can attract more buyers and faster offers. In a foreclosure situation, a quick sale at 95% of market value beats no sale at all.

Step 6: Gather Documentation

Having your paperwork organized speeds up the process:

- Mortgage statements (most recent)

- Payoff letter from lender

- Property tax records

- Title information

- HOA documents if applicable

- Hardship letter (for short sales)

- Financial documentation (for short sales)

Step 7: Close Before the Auction

The sale isn’t complete until it closes and your lender is paid off. Coordinate carefully with your buyer, the title company, and your lender to ensure everything happens before the scheduled auction date.

Critical steps:

- Confirm your auction date and work backward to set deadlines

- Ensure your buyer’s financing (if any) is solid

- Stay in communication with all parties

- Get written confirmation from your lender that foreclosure proceedings will be dismissed upon payoff

If you’re cutting it close, ask your lender if they’ll postpone the auction while the sale is pending. Many will, especially if you have a signed contract and a clear path to closing.

Common Questions About Selling a House in Foreclosure in Kentucky

Can I sell my house after the foreclosure auction?

Only in limited circumstances. If your home sold at auction for less than two-thirds of its appraised value, Kentucky law gives you a six-month redemption period (starting from the auction date) during which you can buy back the property. You’d need to pay the auction sale price plus 10% annual interest plus any reasonable costs the purchaser incurred.

In practice, this is extremely difficult. You’d need to come up with a significant amount of cash quickly, and convincing a new buyer to purchase a property you’re trying to redeem is complicated.

The bottom line: Do everything you can to sell before the auction. Once the gavel falls, your options become severely limited.

Will I owe money after foreclosure?

Possibly, Kentucky allows deficiency judgments, which means if your house sells at auction for less than what you owe, your lender can sue you for the difference.

If you owe $200,000 and your house sells at auction for $150,000, your lender could pursue a judgment against you for the $50,000 difference, plus legal costs.

Selling before foreclosure, even at a loss, can help you negotiate with your lender about any shortfall. Filing for bankruptcy is another way to eliminate deficiency judgment liability.

How does foreclosure affect my credit?

A foreclosure typically causes your credit score to drop by 100 points or more. The exact impact depends on your starting score (people with higher scores often see larger drops) and your overall credit profile.

The foreclosure stays on your credit report for seven years from the date of the first missed payment. During this time, you may find it difficult to:

- Qualify for a new mortgage (most lenders require a 3-7 year waiting period)

- Rent an apartment (many landlords check credit)

- Get approved for car loans or credit cards (or you’ll pay higher interest rates)

Selling before the foreclosure is complete doesn’t eliminate credit damage from missed payments, but it does avoid having an actual foreclosure on your record, which is viewed more negatively.

Can I sell if I’ve already been served with foreclosure papers?

Yes. Being served with papers means the lawsuit has begun, but you still own the property and have the right to sell it. You can sell at any point until the foreclosure sale is confirmed by the court.

However, time is working against you. Once papers are served, you need to move quickly. A cash sale that can close in 1-2 weeks becomes much more practical than a traditional sale that might take 2-3 months.

What if I owe more than my house is worth?

You have several options:

Short sale: Work with your lender to accept less than the full payoff. This requires lender approval and documentation of financial hardship.

Cash sale with lender negotiation: Some cash buyers have experience negotiating with lenders on short payoffs. The buyer handles the negotiation as part of the transaction.

Deed in lieu: If you can’t sell, you may be able to voluntarily transfer the property to your lender and negotiate forgiveness of any deficiency.

In all these scenarios, you’ll need your lender’s cooperation. Start the conversation early.

Do I need to tell buyers my house is in foreclosure?

Kentucky law requires sellers to disclose material facts about the property. The foreclosure itself is already public record through the lis pendens filing, so buyers or their title companies will discover it during due diligence.

Being upfront about your situation is both legally required and practically smart. Many buyers and investors specifically look for pre-foreclosure properties because they can often be purchased below market value with motivated sellers.

Kentucky Resources for Homeowners Facing Foreclosure

You don’t have to navigate this alone. Here are legitimate resources that can help:

Free Counseling and Assistance

Kentucky Homeownership Protection Center

Website: protectmykyhome.org

Provides free foreclosure prevention counseling and resources for Kentucky homeowners.

Kentucky Housing Corporation

Offers various homeowner assistance programs, including help with mortgage payments for qualifying homeowners.

Kentucky Homeowner Assistance Fund (HOAF)

This program used federal funds to help eligible Kentucky homeowners who experienced financial hardship with mortgage payments and other housing costs. As of early 2025, this program is no longer accepting new applications due to fund depletion. However, program status can change; verify directly with the Kentucky Housing Corporation for the most current information.

HUD-Approved Housing Counselors

The U.S. Department of Housing and Urban Development maintains a list of approved counseling agencies in Kentucky that offer free foreclosure prevention counseling. Visit hud.gov or call 1-800-569-4287.

Kentucky Legal Aid

Provides free legal assistance to qualifying low-income Kentucky residents facing foreclosure. Visit klaid.org to find your local office.

What to Avoid

Foreclosure “rescue” companies: Be extremely cautious of any company that charges upfront fees for foreclosure help or promises to “save” your home. Many of these are scams.

Paying for free services: Housing counseling through HUD-approved agencies is free. Don’t pay someone for services you can get at no cost.

Signing over your deed: Never sign any document that transfers ownership of your property to someone else as part of a “rescue” scheme. This is a common scam that leaves you without your home and potentially still liable for the mortgage.

High-pressure tactics: Legitimate professionals give you time to make informed decisions. Anyone pressuring you to act immediately or sign documents without reading them should be viewed with suspicion.

When a Cash Sale Makes Sense

At We Buy 502, we purchase houses for cash throughout Kentucky. We want to be straightforward with you about what we offer and when it makes sense.

The Reality of Cash Buyers

Here’s what working with a cash buyer like us actually looks like:

- We cover closing costs. Unlike a traditional sale where you’d pay 2-3% in closing costs plus 5-6% in agent commissions, we pay these costs. This narrows the gap between our offer and your net proceeds from a traditional sale.

- We buy as-is. You don’t need to make repairs, clean up, or even remove all your belongings. We buy the property in its current condition.

- We can close fast. When time matters, we can close in as little as 10-14 days. We don’t need financing approval or lengthy inspections.

When This Works For You

A cash sale to an investor makes sense when:

- Your auction date is weeks away, not months. If you don’t have time for a traditional sale, we can close before the auction.

- Your property needs significant repairs. If your house has deferred maintenance, damage, or needs major updates, cash buyers purchase regardless of condition. You won’t need to invest money you don’t have into repairs.

- You need certainty. Traditional sales can fall through due to financing issues, inspection problems, or buyer cold feet. Cash offers don’t have those risks.

- Speed and simplicity are your priority. If you just want to move on from this chapter of your life quickly, a cash sale gets you there faster.

- You’ve weighed the trade-offs. If you understand you’re accepting a lower price in exchange for speed and convenience, and that trade-off works for your situation.

When You Should Consider Other Options

A cash sale may NOT be your best choice when:

- You have significant equity and time. If you have 60+ days and substantial equity, a traditional sale likely puts more money in your pocket, even after agent commissions.

- Your property is in good condition. Move-in ready homes attract retail buyers who pay market prices. Don’t leave money on the table if you don’t have to.

- You’re early in the foreclosure process. If you just received your first warning letters, you have time to explore all options before committing to a lower-priced sale.

How We Work

- Free, no-obligation cash offer. We’ll evaluate your property and give you an offer. No cost, no commitment.

- Honest assessment. If we don’t think we’re your best option, we’ll tell you. Our reputation matters more than any single transaction.

- You stay in control. We don’t pressure you. Take our offer, compare it to your other options, and decide what’s best for your situation.

- No fees or commissions. We buy direct. No agent commissions, no closing costs for you, no hidden fees.

Taking Action Today

The most important thing you can do is take action. Foreclosure doesn’t get better with time, and the earlier you engage with your options, the more choices you have.

If You’re Early in the Process (Less Than 120 Days Behind)

You have the most options right now. Use this time wisely.

- Contact your lender about loss mitigation options. Ask specifically about loan modification and forbearance.

- Contact a HUD-approved housing counselor. This is free, and they can help you understand all your options and negotiate with your lender.

- Assess your financial situation honestly. Can you afford your home long-term, or is this a sign that it’s time to downsize or make a change?

- Explore all options before committing to any single path. Get a market analysis of your home’s value. Consider whether selling (and potentially buying something more affordable) makes sense.

If You’ve Been Served with Foreclosure Papers

The clock is now ticking. You need to act with purpose.

- Don’t ignore the papers. You have 20 days to respond. Failing to respond leads to default judgment and accelerates the process.

- Consult with a foreclosure attorney. Many offer free consultations. Understand your legal options and potential defenses.

- Contact your lender about selling the property. Let them know your intentions.

- Get your home’s value assessed. Contact a real estate agent for a market analysis or reach out to cash buyers for offers.

- Decide on your approach and execute quickly. You don’t have time for extended deliberation.

If an Auction Date Is Scheduled

Time is critical. Focus on what can actually be accomplished.

- Confirm the exact auction date. Verify this with the master commissioner’s office or your attorney.

- Contact cash buyers immediately. Get offers from multiple buyers. Ask about their timeline and ability to close before your auction date.

- Explore short sale if you have any time at all. Some lenders can approve short sales quickly in urgent situations.

- Consider bankruptcy as a last resort. Filing bankruptcy triggers an automatic stay that stops the auction, at least temporarily. This buys time but has significant consequences. Talk to a bankruptcy attorney immediately if you’re considering this option.

- Act today. Every day you wait is a day less you have to work with.

Get Your Options Today

Whatever your situation, understanding your options is the first step toward taking control.

At We Buy 502, we provide free, no-obligation cash offers for Kentucky houses in any condition. We’ll give you an honest assessment of whether a cash sale makes sense for your situation or if you might be better served by another path.

To get your free cash offer:

- Call or text us at (502) 849-5950 or fill out the quick form below

- We’ll respond within 24 hours with a no-obligation offer

You have more options than you think. Let’s figure out the right one together.

Last Updated: January 2026

Disclaimer: This article provides general information about the Kentucky foreclosure process and is not legal advice. Foreclosure laws are complex and your specific situation may involve factors not covered here. We recommend consulting with a licensed attorney and/or HUD-approved housing counselor for advice tailored to your circumstances.

Sources and Legal References

- Kentucky Revised Statutes Chapter 426 (Foreclosure proceedings)

- KRS § 426.005 (Deficiency judgments)

- KRS § 426.200 (Notice of sale requirements)

- KRS § 426.260 (Possession after sale)

- KRS § 426.530 (Redemption rights)

- KRS § 426.560 (Appraisal requirements)

- Kentucky Rules of Civil Procedure 4.02 (Response timeline)

- 12 C.F.R. § 1024.39 (Federal servicer contact requirements)

- 12 C.F.R. § 1024.41 (Federal loss mitigation procedures and 120-day rule)